Excel workbook detailing, over various time periods, asset totals, inflows and affiliate trends among Mexican Afores. Data as December 2013.

Companies mentioned in this report: XX Banorte; Banamex; Sura; Profuturo GNP; Principal; Invercap; PensionISSSTE; Inbursa; Coppel; Metlife; Azteca; Afirme Bajío.

Archives for January 2014

Mexican Pension Fund Industry Statistics – December 2013

Regional Mutual Fund Managers Industry Statistics – December 2013

Excel workbook detailing, over various time periods, mutual fund industry asset growth by managers. Data as of December, 2013.

Companies mentioned in this report: Pellegrini; Galicia Adm. De Fondo; Schroders; Banco do Brasil; Itaú Unibanco; Bradesco; Banchile; Santander; BCI; BBVA Bancomer; Banamex; Credifondo; BBVA Fondos; Scotia Perú; Interfondo; and others.

Companies mentioned in this report: Pellegrini; Galicia Adm. De Fondo; Schroders; Banco do Brasil; Itaú Unibanco; Bradesco; Banchile; Santander; BCI; BBVA Bancomer; Banamex; Credifondo; BBVA Fondos; Scotia Perú; Interfondo.

Fabiano Cintra now in command of Itaú’s ETF distribution

The It Now series of ETFs are Brazilian-based exchange-traded funds investing in Bovespa-listed securities.

Schroders Brazil names new chief investment officer amid run on AUM

Schroders Brasil has lost two members of its investment-management team in the last six months. The latest change comes on the heels of a difficult 2013 for equity managers in Brazil and especially for Schroder, which suffered significant outflows.

Brazilian Mutual Fund Manager Net New Investments (NNI) Report – December 2013

Excel workbook detailing net new investments (NNI) of all locally registered Brazilian mutual managers. Also includes monthly and year to date NNI data by managers. Data as of December, 2013.

Companies mentioned in this report: Banco do Brasil, Itaú Unibanco, Bradesco, Caixa Econômica Federal, Santander Brasil, BTG Pactual, HSBC, Credit Suisse, J Safra Asset Mgt., Votorantim, Legg Mason, BNY Mellon Asset Mgt., Funcef, JP Morgan, BNP Paribas, Fundacao Cesp, Citigroup, Vinci Partners, Opportunity, Sul America Investimentos, Intrag, BRL Trust, Quantitas, Real Grandeza, Morgan Stanley, BW, GPS - CFO, JGP, Icatu, SPX, Gávea, Fundacao Sistel, Porto Seguro, Pátria, Pessoas fisicas Fundacao, Integral Investimentos, GAP Prudential, Banrisul, Plural Capital, Vale do Rio Doce Fundacao, Fapes Fundacao, Mapfre, Riviera, Oliveira Trust, Alfa, Brasilprev Seguros, Pragma, BNB, Dynamo, Kinea, and others.

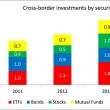

Cross-border investment by Mexican mutual funds hits record levels

Total cross-border investment for Mexican mutual funds reached USD 4.5 billion in 2013. In the process, active managers Franklin Templeton, BNP Paribas, BlackRock, Pioneer Investment, Henderson, JP Morgan and Robeco have successfully landed allocations. Latin Asset Management projects that Mexican fund managers will steer a considerable amount to cross-border instruments in the next five years, creating an interesting alternative to the slow-moving Afore mandate segment.

It’s official: CorpBanca and Itaú announce deal, enhancing Brazilian firm’s presence in Andean region

The transaction will create the newest Andean banking platform, and catapult Itaú into a region-wide force to be reckoned with throughout Latin America. As a result of the merger, the branch network will consist of 217 branches in Chile and 172 branches in Colombia, all using the Itaú brand name.

CCR Monthly Approval Report – January 2014

A rundown of the financial instruments approved, rejected and affirmed by the Comisión Clasificadora de Riesgo (CCR). Month of January 2014. New funds from Nuveen, Federated Investors, Axa and BlackRock were added, while two JPMorgan funds were delisted. Four new iShares ETFs also joined the list.

Argentine Mutual Fund Industry Net New Investments (NNI) Report – December 2013

Excel workbook detailing net new investments (NNI) of all locally registered Argentine mutual funds, asset managers and industry sectors. Also includes monthly and year to date NNI data by asset class, region, sector and manager by sector. Data as of December, 2013.

Companies mentioned in this report: Adm. Tit y Val.; Allaria Ledesma; Arpenta; Axis; Balanz; Bayfe; Frances ADM. de Inv.; BNP Paribas; bST; Cima; CMA; Cohen; Consultatio; Convexity; Facimex; BACS; Fondcapital; Gainvest; Galicia; Galileo; GPS Inestments; Gte de Fondos; HSBC; Itaú; Macro; Mariva; MBA; Megainver; Patagonia; Pellegrini; Proahorro; Provincia;RJ Delta; Sancor Seguros; Santader Río; SBS; Schroders; Surthern Trust; Standard Bank; Supervielle.

Exclusive: XXI Banorte selects managers for European mandate

In an interview with Fund Pro Latin America, the Afore, Mexico's largest with USD 42 billion in assets under management, shared the names of the two winning firms, and said it would allocate up to USD 250 million to each firm. Meanwhile, the pension manager also said selection of a custodian was not yet finalized and that another RFP was being readied. View article for full details.