Excel workbook detailing, over various time periods, returns of each international fund/ETF receiving investments from Mexican Mutual Funds. Period ending January 31, 2014.

Companies mentioned in this report: Aberdeen; BBVA; BlackRock; BNP Paribas; EDM; Fidelity; First Trust; Franklin Templeton; Global X; Henderson; ING; Investec; iShares; JP Morgan; MFS; Morgan Stanley; Oppenheim; Pioneer; PowerShares; Principal; ProShares; Robeco; Santanders; Schroder; State Street; Van Eck; Vanguard; WisdomTree.

Performance Report – Mexican Mutual Fund Investments in Cross-Border Funds and ETFs – January 2014

Bruising January for cross-border investments, but local options took a worse beating

Only two equity funds and ETFs among the 144 which receive allocations from Chilean AFPs ended the first month of the year with a positive return. The worst performing vehicle lost 12% for the month.

League Table – Assets Gathered by Cross-Border Fund Managers and ETFs Sponsors – Colombian Pension Funds – November 2013

Includes assets gathered by cross-border fund managers and ETFs sponsors in the Colombian pension funds market. Also includes monthly inflows / outflows and market share. Data as November 30, 2013.

Companies mentioned in this report: iShares; Dimensional; Aberdeen; Investec; Franklin Templeton; Morgan Stanley; BlackRock, ING; MFS; Amundi; Fidelity; Matthews Funds; Invesco; JP Morgan; BBH; Deka; AllianceBernstein; LarrainVial; AZ Fund Management; BNY Mellon; BNP Mellon; HSBC; BNP Paribas; Allianz; Lyxor; Protección; Porvenir; Colfondos; Skandia; Horizonte; HSBC; FiduDavivienda.

Performance Report – Chilean AFP Investments in Cross-Border Funds and ETFs – January 2014

Excel workbook detailing, over various time periods, returns of each international fund/ETF receiving investments from Chilean AFP. Period ending January 31, 2014.

Companies mentioned in this report: Aberdeen; Alfred; Berg; AllianceBernstein; Allianz; Ashmore; Aviva; Investors; Axa; BlackRock; BlueBay; BNP; Paribas; BNY; Mellon; AM; BTG; Pactual; Deutsche; Dimensional; DWS; Edmond; de; Rothschild; F&C; Fidelity; Franklin; Templeton; GAM; GLG; Goldman; Sachs; ; Henderson; HSBC; ING; Invesco; Investec; iShares; JP; Morgan; Julius; Baer; LarrainVial; M&G; Matthews; MFS; Morgan; Stanley; Natixis; Oppenheimer; Pictet; PIMCO; Pioneer; Robeco; Schroder; SEB; State; Street; Swiss & Global; Threadneedle; TIAA-CREF; UBS; Van; Eck; Vanguard; Vontobel; WisdomTree.

Argentine unit of Raymond James seals institutional distribution deals with two major US fund houses

The firm, which has already been distributing Eagle Asset Management products in Latin America, announced the strategic alliance on Jan. 30. A total 21 funds were registered for sale with the CCR in Chile.

Van Eck Global adds two Market Vectors ETFs to Mexican offering

Two fixed-income ETFs were added to the long list of 32 products that Van Eck can offer to Mexican pension and and mutual-fund managers through the local stock exchange. Deutsche Securities will act as local sponsor.

Four cross-border funds landed first-time investments in November from Colombian AFPs

Colombian pension funds added another USD 415 million to their holdings of cross-border ETFs and mutual funds in November, surpassing the USD 9 billion level. Aberdeen, BlackRock, Investec and Schroders all succeeded in landing a first-time investment for an equity product during the month.

Holdings Report – Colombian Pension Fund Investment in Cross-Border Securities – November 2013

Excel workbook detailing Colombian pension fund (Obligatory + Voluntary) allocations to cross-border mutual funds, ETFs, private equity funds, bonds, stocks and other securities. Includes names of all securities as well as amounts invested in each. Also included is a breakdown of offshore allocations by asset class.

Companies mentioned in this report: Aberdeen; AllianceBernstein; Allianz; Amundi; AZ Fund Management; BBH; BlackRock; BNP Paribas; BNY Mellon; Deka; Dimensional; Fidelity; Franklin Templeton; HSBC; ING; Invesco; Investec; iShares; JP Morgan; LarrainVial; Lyxor; Matthews Funds; MFS; Morgan Stanley; N/A; Pictet; Pimco; Pioneer; PowerShares; ProShares; Robeco; Schroder; State Street; Van Eck; Vanguard; Vontobel; WisdomTree; Proteccion; Porvenir; Colfondos; Horizonte; Skandia; HSBC; FiduDavivienda; FiduColombia; Colseguros; Fiduciar.

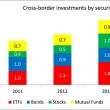

Cross-border investment by Mexican mutual funds hits record levels

Total cross-border investment for Mexican mutual funds reached USD 4.5 billion in 2013. In the process, active managers Franklin Templeton, BNP Paribas, BlackRock, Pioneer Investment, Henderson, JP Morgan and Robeco have successfully landed allocations. Latin Asset Management projects that Mexican fund managers will steer a considerable amount to cross-border instruments in the next five years, creating an interesting alternative to the slow-moving Afore mandate segment.

Exclusive: XXI Banorte selects managers for European mandate

In an interview with Fund Pro Latin America, the Afore, Mexico's largest with USD 42 billion in assets under management, shared the names of the two winning firms, and said it would allocate up to USD 250 million to each firm. Meanwhile, the pension manager also said selection of a custodian was not yet finalized and that another RFP was being readied. View article for full details.