The asset manager hopes the two funds, which launched on Jan. 6, will raise a combined BRL 600 million in the first quarter of 2014.

Colombian pension managers added a USD 1 billion to their cross-border portfolios in October

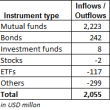

Colombian AFP pension funds added USD 580 million to their positions in cross-border securities in October, of which 80% was applied to ETFs. Purchases were concentrated in equity-oriented products to the USA and Europe. Products of State Street and iShares benefitted the most for the new inflows.

Performance Report – Mexican Mutual Fund Investments in Cross-Border Funds and ETFs – December 2013

Excel workbook detailing, over various time periods, returns of each international fund/ETF receiving investments from Mexican Mutual Funds. Period ending December 31, 2013.

Companies mentioned in this report: Aberdeen; BBVA; BlackRock; BNP Paribas; EDM; Fidelity; First Trust; Franklin Templeton; Global X; Henderson; ING; Investec; iShares; JP Morgan; MFS; Morgan Stanley; Oppenheim Pramerica; Pioneer; PowerShares; Principal; ProShares; Robeco; Santander; Schroder; State Street; Van Eck; Vanguard; WisdomTree

Performance Report – Chilean AFP Investments in Cross-Border Funds and ETFs – December 2013

Excel workbook detailing, over various time periods, returns of each international fund/ETF receiving investments from Chilean AFP. Period ending December 31, 2013.

Companies mentioned in this report: Aberdeen; Alfred; Berg; AllianceBernstein; Allianz; Ashmore; Aviva; Investors; Axa; BlackRock; BlueBay; BNP; Paribas; BNY; Mellon; AM; BTG; Pactual; Deutsche; Dimensional; Edmond; de; Rothschild; F&C; Fidelity; Franklin; Templeton; GAM; GLG; Goldman; Sachs; ; Henderson; HSBC; ING; Invesco; Investec; iShares; JP; Morgan; Julius; Baer; LarrainVial; M&G; Matthews; MFS; Morgan; Stanley; Natixis; Oppenheimer; Pictet; PIMCO; Pioneer; Robeco; Schroder; SEB; State; Street; Threadneedle; TIAA-CREF; UBS; Van; Eck; Vanguard; Vontobel; WisdomTree.

Holdings Report – Colombian Pension Fund Investment in Cross-Border Securities – October 2013

Excel workbook detailing Colombian pension fund (Obligatory + Voluntary) allocations to cross-border mutual funds, ETFs, private equity funds, bonds, stocks and other securities. Includes names of all securities as well as amounts invested in each. Also included is a breakdown of offshore allocations by asset class.

Companies mentioned in this report: Aberdeen; AllianceBernstein; Allianz; Amundi; AZ Fund Management; BBH; BlackRock; BNP Paribas; BNY Mellon; Deka; Dimensional; Fidelity; Franklin Templeton; HSBC; ING; Invesco; Investec; iShares; JP Morgan; LarrainVial; Lyxor; Matthews Funds; MFS; Morgan Stanley; N/A; Pictet; Pimco; Pioneer; PowerShares; ProShares; Robeco; Schroder; State Street; Van Eck; Vanguard; Vontobel; WisdomTree; Proteccion; Porvenir; Colfondos; Horizonte; Skandia; HSBC; FiduDavivienda; FiduColombia; Colseguros; Fiduciar.

Holdings Report – Assets Gathered by Cross-Border Fund Managers – Latin American Institutional Market – September 2013

Excel workbook detailing assets gathered by cross-border fund managers in the following markets: Chilean pension funds (AFPs) and mutual funds, Colombian pension funds (AFPs), Mexican pension funds (Afores) and mutual funds and Peruvian pension funds (AFPs) . Data as of September 30, 2013.

Companies mentioned in this report: Aberdeen; Franklin Templeton; Fidelity; Investec; Schroders; Dimensional; Axa; Vanguard; JP Morgan; Julius Baer; Robeco; BNP Paribas; Pioneer; BlackRock; Invesco; BNY Mellon AM; Goldman Sachs; Vontobel; Pictet; Deutsche; Ashmore; PIMCO; Allianz; Threadneedle; Matthews Funds; Aviva Investors; MFS; HSBC; BlueBay; AllianceBernstein; Morgan Stanley; UBS; Edmond de Rothschild; LarrainVial; M&G; BBH; BTG Pactual; ING; Muzinich; Janus; Amundi; Henderson; F&C; GAM; WisdomTree; SEB; Principal; GLG; TIAA-CREF; Alfred Berg; EDM; Deka; Oppenheim Pramerica; Nomura; Credit Suisse; Legg Mason; WestLB; La Française AM; Carmignac; Brown Advisory; Santander; Dexia; AZ Fund Management; REYL; PineBridge; Natixis; Nordea; Manulife; Raiffeisen; Baring; EuroAmerica; Traditional Funds; Schwab; Skandia; East Capital; Bestinver; Neuberger Berman; Baron; First State Investments; Lombard Odier; T. Rowe Price; SEI; NEVASA HMC

Peruvian AFPs ask SBS to consider Latam allocations as “local” investments

The maneuver would free up another 4% of quota for investing in cross-border instruments domiciled outside of the region.

Chilean AFPs were strong buyers of cross-border mutual funds in November

Chilean pension funds made over USD 2 billion in new allocations, bringing total non-domestic investment to USD 68.8 billion. Cross-border mutual funds and direct investments in government bonds were the most chosen instruments type to increase positions. Products of Axa, Pioneer, BlackRock, and Invesco benefitted the most from the renewed enthusiasm of the AFPs.

Principal Chile explores shopping offshore fund to local and global investors

The vehicle is a Latin American equities fund domiciled in Dublin, which will be co-managed by the company’s teams in Brazil, Mexico and Chile, where each will contribute its view on the market and companies in its own country and areas of influence.

Peruvian AFP cross-border limit to be raised to 40% by July 2014

The Central Bank of Reserve (BCR) increased to 36.5% the limit of AFP investment abroad, which comes into effect from December 15th. But by July 15, 2014, as part of a schedule of gradual increases of 0.5% every 30 days, it will reach 40%.